Introduction

In these times of such massive uncertainty, the crisis of covid-19 reveals the increasingly fragility of the capitalist economy. The heterodox approach should necessarily be used for the economic recovery through Modern Money Theory. This new approach to resolve crisis in term of aggregate demand and full employment came at a crucial time in the trajectory of heterodox macroeconomic theory. In this regards, Heterodox macroeconomics analysis is clearly intended to be that of a monetary capitalist economy in which the monetary and financial sectors play a central role (in contrast to the passive monetary sector as envisaged in most mainstream macroeconomics) (Sawyer, 2009: 25).

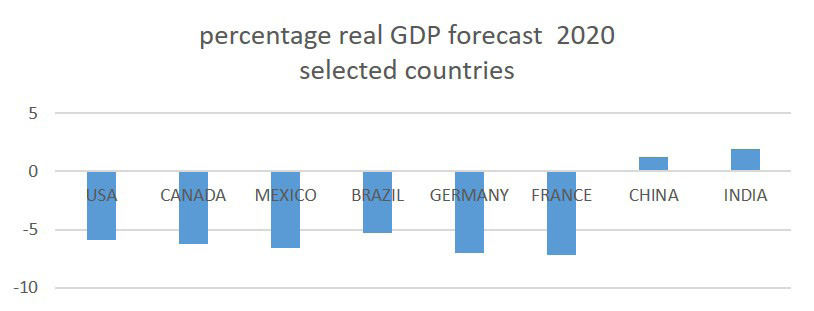

The rapid spread of the Covid-19 forces governments all over the world have decided to switch off almost all economic activities, travel restrictions and bans globally. Despite all these measures, many people have been infected by this virus. Many indicators show that the economic impact and consequences of COVID-19 will be worse than the Great Financial Crisis in 2008 (Desilus, 2020: 6). According to the International Monetary Fund (IMF, 2020), the lockdowns have led to record unemployment at 14.7 percent in United States, the Gross Domestic Product (GDP) will decrease -5.9%, -6.6% for Mexico and -6.2 for Canada, the same pattern for other industrialized countries.

In addition, there was a sharp drop in the prices of basic products. During the first trimester of this year, the prices of basic commodities such as natural gas, crude oil have substantially reduced. Both developed and developing countries face a fundamentally unstable invest- or-die situation.

According to World Bank (WB):

Oil markets have been most affected, given the collapse in travel arising from mitigation measures, and have seen an unprecedented collapse in demand and steepest one-month decline in oil prices on record. Metals prices have also fallen, albeit less than oil, while agricultural prices have been much less affected so far given their indirect relationship with economic activity. Over the short-term, in addition to weaker demand, disruptions to supply chains could cause dislocations in commodity markets, with food security a key concern. (WB: April 2020)

In this Covid-19 crisis, there is a consensus in the economic debate that government expenditure using money as key determinant for recovery. In this paper, the role of endogenous money1 and the interest rates as a key feature of heterodox macroeconomics play a central role for the economic recovery in this strange time of Covid-19. Also, we will pretend to respond why the heterodox macroeconomics ideas is the most adequate, capable and flexible of making this economic crisis solvent in this modern macrodynamics.

However, the mainstream neoclassical approach presents a view of laissez faire, laissez passer of the monetary policy. Over the past four decades, the mainstream perspectives emphasize on opening financial markets with a view to promoting prosperity. Based on this approach, restrictive monetary and fiscal policies have been enforced on many countries by the International Monetary Fund’s austerity policies (Goldstein and Hillard, 2009: 61).

In this paper, we will analyze both endogenous money and interest rate as key elements in the heterodox macroeconomics. the concept of endogenous money fits well with the current approach to monetary policy based on the setting (or targeting) of a key interest rate by the Central Bank. In endogenous-money models, the causal relationship between the stock of money and prices is reversed as compared with the exogenous money case. (Arestis and Sawyer, 2003: 1-2)

1. Some historical background of money

It is very important to analyze how money come into existence and what is its main function in the economic activities. In macroeconomic history, the concept of money as means of payment represents the fundament transformation in the dynamics of the capitalist system. For Knapp, money is a creature of law. A theory of money must, therefore, deal with legal history (Knapp, 1924: 1). How money is created, by whom, and on what terms actually creates an artificial world of winners and losers (Greco, 2001: 6), these questions play a central core of the heterodox macroeconomics. The Federal Reserve Bank of Chicago (FRBC) examines, in more detail, the Modern Money Mechanics and its implications for macroeconomic dynamics.

“If money is viewed simply as a tool used to facilitate transactions, only those media that are readily accepted in exchange for goods, services, and other assets need to be considered. […]What makes money acceptable it is the confidence people have that they will be able to exchange such money for other financial assets and real goods and services whenever they choose to do so.[…]Then, bankers discovered that they could make loans merely by giving their promises to pay, or bank notes, to borrowers. In this way, banks began to create money. More notes could be issued than the gold and coin on hand because only a portion of the notes outstanding would be presented for payment at any one time. Enough metallic money had to be kept on hand, of course, to redeem whatever volume of notes was presented for payment. (Federal Reserve Bank of Chicago, 1998: 2, 3)”

Heterodox economists present a view of endogenous money in a sense that money is crucial factor of the relation between aggregate demand and economic growth. Marc Lavoie (1984: 777) mentions that loans make deposits and deposits make reserves. What is the most interesting about Lavoie’s contribution is that without the supply of money, entrepreneurs cannot produce a new flow of commodities in a given time. Thus, money should be understood as income-money and credit-money. In this context it is worth quoting Arestis’s approach concerning the nature and role of money. He argued that the concept of endogenous money fits well with the current approach to monetary policy based on the setting (or targeting) of a key interest rates by the Central Bank (Arestis and Sawyer, 2003: 1)

Soddy (1934) presents an analysis of money in a manner which seeks to emphasize that the interaction between creditor and debtor necessarily must be in money terms, the owner of money is the creditor and the issuer of it is the debtor. For Soddy, money now is the NOTHING you get for SOMETHING before you can get ANYTHING (Soddy, 1934: 24). These concepts are also used to determine the real value of goods and services regardless of the form of money. Under this definition, Soddy extended his analysis to include the monetary policy. He included the notion of weights and measures policy for a better understanding of monetary policy. At the same token, monetary policy would be best considered as the most important policy to provide the financial resources needed for the aggregate demand.

Joseph A. Schumpeter in business cycles (1939) focused on consumers’ borrowing on the one hand and saving and accumulation on the other hand. He believed that those elements should be considered as the monetary complement of innovation and which need to be financed by credit creation. Schumpeter insisted that:

“the logical relation which they embody, between what is called “credit creation by banks” and innovation, will not be lost again. This relation, which is fundamental to the understanding of the capitalist engine, is at the bottom of all the problems of money and credit, at least as far as they are not simply problems of public finance (Schumpeter,1939: 109)”.

The quit essence of Lerner’s theory about “Functional Finance” seems to be relevant to the economic consequences of the Covid-19. In particular, he analyzed the monetary aspect to restore full employment in times of an economic crisis is through government spending and printing money. In this case, he adopted the idea that taxation could reduce inflation. He mentioned that:

Functional Finance rejects completely the traditional doctrines of “sound finance” and the principle of trying to balance the budget over a solar year or any other arbitrary period. In their place it prescribes: first, the adjustment of total spending (by everybody in the economy, including the government) in order to eliminate both unemployment and inflation, using government spending when total spending is too low and taxation when total spending is too high; second, the adjustment of public holdings of money and of government bonds, by government borrowing or debt repayment, in order to achieve the rate of interest which results in the most desirable level of investment; and, third, the printing, hoarding or destruction of money as needed for carrying out the first two parts of the program. (Lerner, 1943: 41)

Hyman Minsky (1986) sounds very much like Lerner and offers a detail understanding of money concerning financial fragility. Everyone who has studied Minsky’s work will recall the importance of money where borrowers cannot meet the payment commitments. Minsky was concerned by this because in his theory of financial hypothesis which Hedge finance units and Ponzi finance represent crucial point in the finance system. He noted that:

“hedge financing units are those which can fulfill all of their contractual payment obligations by their cash flows: the greater the weight of equity financing in the liability structure, the greater the likelihood that the unit is a hedge financing unit. […] For Ponzi units, the cash flows from operations are not sufficient to fulfill either the repayment of principle or the interest due on outstanding debts by their cash flows from operations. Such units can sell assets or borrow. Borrowing to pay interest or selling assets to pay interest (and even dividends) on common stock lowers the equity of a unit, even as it increases liabilities and the prior commitment of future incomes. A unit that Ponzi finance slowers the margin of safety that it offers the holders of its debt. (Minsky,1992: 7)”

When there are working people that are facing difficulties to meet the payment commitments, stagnation will occur, thus, will affect the liquidity preference of borrowers and lenders. In this regard, the government is thus always in a position to prevent a financial crisis if it acts to provide cash to those institutions who need it to meet their debt commitments. This highlights the importance of the central bank as the only institution capable of offsetting a shortfall in earnings and providing liquidity through discount window lending to provide the validation of assets that will prevent a financial crisis (Kregel, 2012: 164).

Indeed, based on Democratizing Money, Jan Kregel (2019) has moved beyond the established paradigm of Smith and classical/neoclassical models that underline the supply-side equilibrium. He provided a richer understanding of the equal access to the banking system, which finances creation of capital through money. In light of monetary policy as a stabilizing mechanism, government intervention can lead the economy to an equilibrium through the “big-bank” to calm the market and restore order.

This explanation emerged in the debate between orthodox and heterodox approaches regarding government policy interventions. Both schools believe in the crucial role of government in the economy as a whole, but in a different manner. Based on the market led development, the orthodox approach believes the free market can achieve stability and full employment. Thus, government should have a meager intervention in the economy. Meanwhile, the heterodox school embedded the assumption that this economic crisis is endogenous and MMT is a useful approach for the economic recovery (Wray, 2014).

2. Fiscal policy and monetary policy in the covid-19 moment

Most government are ready to reopen their economy activities and the recovery from the covid-19 crisis. This pandemic crisis has a negative effect on the economy as a whole. World Trade is expected to decline by between 13% and 32% in 2020 as the COVID-19 pandemic disrupts normal economic activity and life around the world (WTO, 2020). This report notes:

“all regions will suffer double-digit declines in exports and imports in 2020, except for “Other regions” (which is comprised of Africa, Middle East and Commonwealth of Independent States (CIS) including associate and former member States). This relatively small estimated decline in exports stems from the fact that countries from these regions rely heavily on exports of energy products, demand for which is relatively unaffected by fluctuating prices. If the pandemic is brought under control and trade starts to expand again, most regions could record double-digit rebounds in 2021 of around 21% in the optimistic scenario and 24% in the pessimistic scenario – albeit from a much lower base (WTO, 2020)”

According to the International Monetary Fund (IMF, 2020), both emerging markets and developing countries will suffer a severe decline in exports and imports in 2020. As a result of the Covid-19, the recent World Economic Outlook report (IMF, 2020) mentions that the rate of growth for the global economy would subject to –3 percent this year, an abysmal number compare to 2008 financial crisis.

Based on the historical analysis, most of emerging markets and developing countries are considered as export-commodity-dependent (UNTAD, 2019). The Covid-19 pandemic underlines the continuous financial instability in the global market due to such dependence and its negative impact in these countries.

In this regard, the IMF’s argument seems to offer a deeper understanding on how export-commodity dependent countries have been impacted by the decline of external demand in time of Covid-19. The IMF points out that:

The economic impact has been even more severe as emerging market economies were buffeted by multiple shocks. Compounding the effects of domestic containment measures has been a decline in external demand. Particularly hit are tourism-dependent countries due to a decline in travel and oil exporters as commodity prices plummeted. With global trade and oil prices projected to drop by more than 10 percent and 40 percent respectively, emerging market economies are likely to face an uphill battle (IMF: August 6, 2020).

Figure 1. percentage real GDP forecast 2020 selected countries.

Source: Own elaboration, data from IMF, April 2020

Due to this severe worldwide economic downturn, the heterodox macroeconomics based on Keynes’s contribution seems to be in better position to provide a deep-seated nature of the modern macrodynamics of the world economy. As a response to mitigate the negative economic impact of the Covid-19, most governments use an expansionary fiscal and monetary policy (IMF, 2020). For example, the following table shows how governments shift the special distribution of financial and economic resources to support their economies to limit the negative impact of the Covi-19 pandemic.

Table 1

Fiscal policy (March- April 2020) Selected countries

|

USA |

Canada |

Mexico |

Brazil |

Germany |

France |

China |

India |

|

US2.3 trillion. (11% OF GDP) |

$205 billion CAD. 9.8% of GDP |

US42.3 billion. 3.3% of GDP |

US 85 billion 4.5% of GDP |

US745 billion 19.3% of GDP |

US258 billion 9.5% of GDP |

US788 billion 5.6% of GDP |

US154 billion. 5.2 % of GDP |

Sources: IMF 2020, Center for Strategic and International Studies (CSIS: 2020)

In this economic downturn, policy makers and international organizations recognize the need of demand and supply in balance. In this regard, (Georgieva, 2020)2 mentioned:

The IMF has responded at record speed. We doubled our emergency rapid-disbursing capacity to meet expected demand of about $100 billion—and by end-May the IMF had approved financing for 60 countries, a record. We also established a new short-term liquidity line, and we took steps to triple our concessional funding, targeting $17 billion in new loan resources for our Poverty Reduction and Growth Trust, which helps poorer economies.

From this perspective, in March 27th, 2020, the Trump administration decided to implement the Coronavirus Aid, Relief, and Economic Security (CARES) Act in order to provide the liquidity needed and meager the negative effect of Covid-19. The CARES Act is a stimulus package over $2 trillion to keep workers in employed including the $1,200 to everyone who earning up to $75,000 a year (US Department of Treasury, 2020).

Under the CARES Act, concerning the assistance for small business, the Paycheck Protection Program (PPP) is one of the most important significant instruments for the recovery. The PPP consists to provide small business with the financial resources needed to maintaining payroll, employees and cover other utilities. This policy of government intervention of providing liquidity was strongly followed by other developed and developing countries.

In this complex financial system of money-in/money-out, money is a useful/relevant aspect in the heterodox macroeconomic approach. Money is not only a ‘veil’ on economic transactions has neoclassical has it but is constitutive in entire economy (Huber, 2014). Hence, there is an interconnected chain between central bank and financial institutions. It is very important to keep in mind that state created central bank with the power to create money and to provide the needed liquidity in time of crisis (Kregel, 2012: 161).

The issue es much more complicated for developing countries. With money governs finance and finance governs economy, the rate of interest represents a very important element in the expansionary of fiscal policy, which the Central Bank sets the interest rates “at the natural rates of interest”. Starting from this specification of rate of interest, it is interesting to see how Sawyer extended to his natural and role monetary policy when money is endogenous. That said, the interest rate is the most powerful drivers of the monetary policy including the successful periods of monetarism.

There are numerous ways in which the rate of interest may affect the supply-side economics in fiscal and monetary policy. In this regard, Powel3 pointed out that low interest rates have supported economic activity and gradually brought us back to full employment and 2 percent inflation. Better regulation and risk management have so far minimized the tradeoffs between our macroeconomic objectives, on the one hand, and financial stability, on the other (Powel, 2017:7).

The Covid-19 crisis to heterodox macroeconomic theory has pushed that theory to in new and deeper dimension to the economic stagnation associated with state money4. The heterodox macroeconomics policy offers a detailed understanding of the rate of interest in this pandemic crisis. It is perhaps helpful to follow John Maynard Keynes in thinking the rate of interest period. Keynes (1930) recommended the use of the interest rates is the key element to reach the aggregate level of employment and the aggregate demand as a necessary condition for growth. The rate of growth is thus closely linked to the interest rate. Thus, investment and public expenditure must be structured to ease supply constraints.

With respect to MMT, L. Randall Wray considers how interest rates control can facilitate desirable policies pertaining to money supply through Central Bank and full employment. It is clear that the central bank control the interest rates throughout the money supply, trying to increase consumptions.

The socio-economic impacts of Covid-19 crisis forces Central Banks to shift their policies and hold the interest rates near zero. Arestis and Sawyer further strengthen the idea of the role central role of the Central Bank. They argued:

“The Central Bank rate can be viewed as the key rate on which all other interest rates are based--often explicitly so as in the case of the interest rates charged by banks on loans and paid by banks on deposits. However, while that may be a useful way to proceed in the short run (the period over which the Central Bank holds its interest rate constant), it clearly leaves open the question of the forces that influence or determine the Central Bank interest rate in the longer term. This should be seen as a key issue in the analysis of endogenous money, yet it has been generally neglected in the Keynesian endogenous money literature (Arestis and Sawyer, 2003: 9)”

For example, the United States response seems to be especially relevant to the economic impacts of Covid-19 crisis. This response can be viewed as arising of heterodox macroeconomics in term of fiscal and monetary policies. These strategies encourage enterprises to keep workers on payroll, the Paycheck Protection Program (PPP) is one of the instruments of the CARES. The program has the following characteristics:

“This program provides small businesses with funds to pay up to 8 weeks of payroll costs including benefits. Funds can also be used to pay interest on mortgages, rent, and utilities. […]The Paycheck Protection Program prioritizes millions of Americans employed by small businesses by authorizing up to $349 billion toward job retention and certain other expenses.[…] Small businesses and eligible nonprofit organizations, Veterans organizations, and Tribal businesses described in the Small Business Act, as well as individuals who are self-employed or are independent contractors, are eligible if they also meet program size standards (U.S. Department of treasury: 2020)”

Furthermore, it is very clear that the Federal Reserve’s response to the Covid-19 represents the Keynesian concepts of endogenous money/credit, endogenous expectations/preferences. The Federal Reserve obviously understands both investment functions and consumptions depend on the interest rates. In addition, the monetary and credit policies reflect the Keynes’s approach where the state must intervene through the Central Bank to stabilizing an unstable economy. Kim observed, “By means of an increase in the money supply and commodity prices, the state should reduce real wages as an inducement to investment. More radically, by monetary and credit policies the state should lower the rate of interest towards ‘that point relative to the schedule of marginal efficiency of capital at which there is full employment” (Soo Haeng Kim: 2009, interpretation of Keynes 1936: 375).

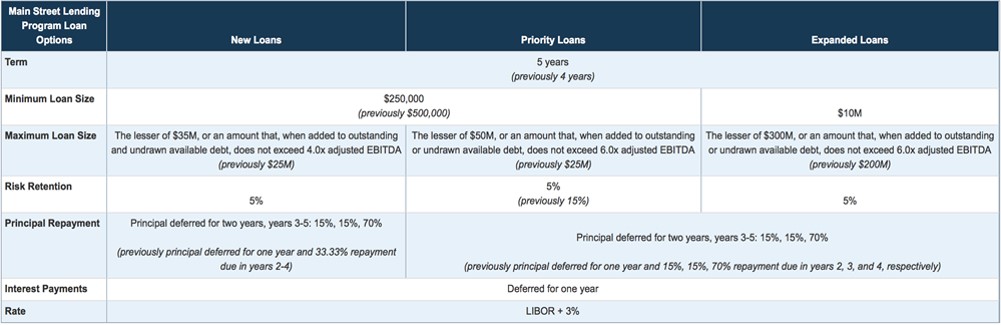

Moreover, the Federal Reserve Board (Fed, 2020) has expanded the Lending Program to allow more small and medium-sized businesses to be able to receive support. This program consists:

- Lowering the minimum loan size for certain loans to $250,000 from $500,000;

- Increasing the maximum loan size for all facilities;

- Increasing the term of each loan option to five years, from four years;

- Extending the repayment period for all loans by delaying principal payments for two years, rather than one; and

- Raising the Reserve Bank’s participation to 95% for all loans. (Federal Reserve, June 2020)

Figure 2 provides a clear understanding how the Federal Reserve uses the endogenous money, the interest rates and raised the maximum loan limit to small and medium-sized business.

With these measures, the Federal Reserve intends to provide the indispensable financial resources to small business and ensure the economic recovery. It is important to mention that in order to have the expected results of fiscal and monetary policies, they must be aligned in such a way that they can be mutually reinforcing.

Figure 2

US Lending Program

Source: Federal Reserve, 2020

3. Conclusion

In a nutshell, the current pandemic crisis has led to a severe economic stagnation throughout the world. As previously stated, the world economy is projected to decline sharply by –3 percent in 2020. The same (negative panorama) pattern for other variables such as unemployment, consumptions and GDP per capita. The use of the integrated macroeconomic approach for the visible economic impacts need to be directed in such a way that it can increase the aggregate demand as an important condition for economic recovery.

As the International Monetary Fund (IMF, 2020) noted, because the economic fallout is acute in specific sectors, policymakers will need to implement substantial targeted fiscal, monetary, and financial market measures to support affected households and businesses domestically.

As we can see in this paper, the heterodox macroeconomics based on the ideas of Keynes is the only school of thought where the consideration of crises is central for the economic recovery. In addition, the heterodox macroeconomics emphasizes concepts of fundamental uncertainty, endogenous money/credit, endogenous expectations/preferences, financial innovation, financial fragility and effective demand (Goldstein and Hillard, 2009: 9).

This paper also notes, with deeper concern that some scholars still thinking about inflation and fiscal consolidation in this Covid-19 crisis. In this current moment, MMT is useful policy alternatives to overcome of the economic crisis and help government to achieve the important objective which is the full employment and the aggregate demand.

Thus, emerging markets and developing countries with export-led growth such as Mexico should consider the Heterodox Macroeconomics framework as the foundation for the economic recovery. In this challenging time, the interest rate as a key element of monetary policy should be considered as a powerful instrument to boost the economy.

1A vital point for macroeconomic analysis is the concept of endogenous money in steps multifold. The banks loan provision systems become the focal point. Without adequate credits from the banks in addition to a low interest it would be impossible to increase rates of investment, ultimately affecting full employment.

2International Monetary Fund, managing Director

3 See Powel (2017).

4Georg Friedrich Knapp developed the state theory of money, a theory that is directly opposed to the chartalist and Metalist approach. For Knapp, the chartalist defines the unit of value historically. The Chartal theory does not dispute the historical and practical significance of metal; it gives metal its proper place. It was the bridge to chartality; and it is still an auxiliary of exodromy, though not the only one. The general preference for the specie form of valuta money is due to the recognition that, to a certain extent, it supports the inter-valutary exchange, because our money can then be used abroad, at any rate platically. So far, the metallists are right. But the metallists fail to explain currency systems that have no metal. The chartalist has no trouble in explaining them; they are the touchstone of his theory. (Knapp, 1924: 303)